The Main Principles Of Mortgage Broker

Wiki Article

Mortgage Broker - An Overview

Table of ContentsSome Ideas on Mortgage Broker You Need To KnowThe 25-Second Trick For Mortgage BrokerThe Basic Principles Of Mortgage Broker How Mortgage Broker can Save You Time, Stress, and Money.Little Known Facts About Mortgage Broker.Some Known Details About Mortgage Broker

The house is yours. Created in cooperation with Madeleine Mc, Donald., and identifying which loan type would certainly be suitable for the consumer. The broker is just there to help (and also make their commission).

Mortgage Broker Fundamentals Explained

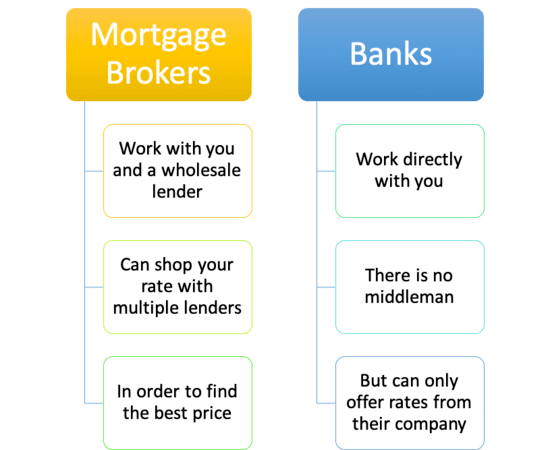

As well as that wants to make an application for a mortgage greater than when? The number of banks/lenders a mortgage broker has access to will differ, as brokers should be accepted to work with each independently. A person that has been in business a long time may have established a a great deal of wholesale companions to select from.They may also recommend that you limit your funding quantity to an adhering quantity so it follows the guidelines of Fannie Mae as well as Freddie Mac. Or they may suggest that you break your financing right into a first and also bank loan to avoid mortgage insurance and/or get a much better blended rate.

As an example, if you have poor debt or are a genuine estate financier, brokers might have wholesale home mortgage companions that concentrate on home loan just for you. They might not work on the retail degree, so you 'd never ever understand concerning them without your broker intermediary. A retail bank might just give you common loan selections based upon the loan application you complete, without any type of more insight in terms of structuring the bargain to your benefit.

Our Mortgage Broker Statements

This is an additional large advantage over a retail financial institution. If you select one of the large banks, you might spend a lot of your time on hold waiting to contact an agent. Furthermore, if your loan is decreased, that's typically the end of the line. With a home mortgage broker, they 'd merely apply at another financial institution, or make needed changes to transform your rejection into an authorization.If you recognize you're looking for a certain type of finance, looking for out one of these specialized brokers can lead to a much better result. They might likewise have partners that stem jumbo home mortgages, assuming your loan quantity exceeds the conforming financing limit. When all the information are ironed out, the broker will certainly send the loan to a loan provider they function with to gain approval.

What they charge can differ greatly, so make certain you do your research prior to agreeing to work with a home mortgage broker. Mortgage Brokers Were Condemned for the Housing Situation, Brokers obtained a lot of flak for the current housing crisis, Particularly considering that agented house finances showed higher default rates, Family member to home finances stemmed through the retail financial network, But eventually they just resold what the banks were supplying themselves, Mortgage brokers were largely criticized for the home mortgage crisis because they stemmed car loans on part of countless financial institutions and weren't paid based on financing performance.

Mortgage Broker - Questions

Per AIME, brokers have traditionally not been given the acknowledgment they deserve for being specialists in their area (mortgage broker). Home Loan Broker FAQLike all other finance originators, brokers bill source costs for their solutions, as well as their charges may differ extensively. It sets you back money to run a mortgage brokerage, though they may run leaner than a large financial institution, passing the cost savings onto you.If they aren't billing you anything straight, they're simply making money a broker commission by the lender, meaning you'll end up with a higher rates of interest to compensate. Make sure to check out all alternatives to get the most effective mix of rate as well as fees. Not always; as mentioned home loan brokers can offer competitive prices that satisfy or beat those of retail banks, so they need to be thought about along with financial institutions when looking for financing.

Furthermore, brokers should generally complete pre-license education and click here for more info learning as well as some has to obtain a bond or meet particular total assets demands. Yes, home mortgage brokers are controlled on both the federal as well as state level, and also must follow a lot of rules to conduct organization. Additionally, consumers are able to seek out broker documents through the NMLS to ensure they are licensed to carry out organization in their state, and to see if any type of actions have been taken versus them in the past.

A Biased View of Mortgage Broker

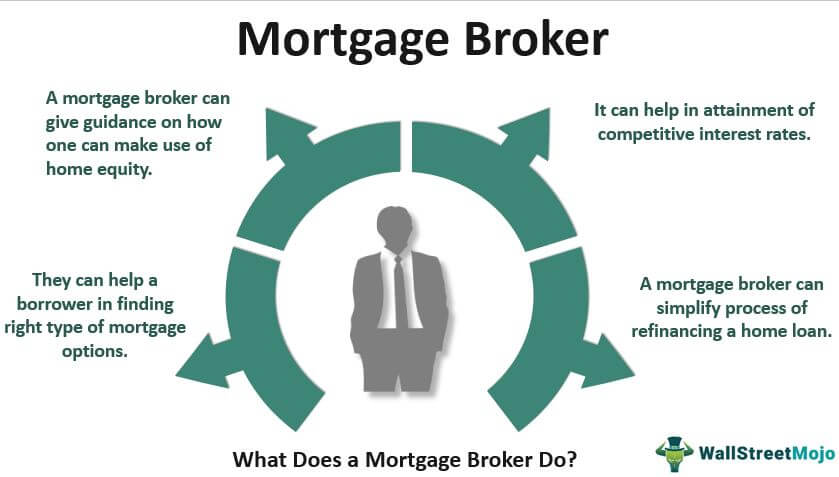

And regardless of the ups and also downs that feature actual estate, they will certainly most likely continue to play an energetic function in the home loan market since they supply a special service that large banks as well as cooperative credit union can't imitate. So while their numbers might change once in a while, their services should constantly be offered somehow.Making use of a home loan broker such as not just makes sound financial feeling, however will certainly supply you with all type of vital help. So, you're looking for home mortgage offers to aid you get a property, yet with a lot of mortgage business as well as home mortgage lenders out there, it can be difficult to recognize where to start.

Mortgage Broker for Beginners

Save you money A home mortgage broker will certainly scour the readily available home loans for you as well as have a look at the most effective offers. This isn't just a case of seeking the click to read more most affordable mortgage prices today, or the most affordable tracker mortgage or least expensive dealt with rate home loan. A knowledgeable home mortgage broker is able to look past the home mortgage rate of interest prices to take into consideration all the other costs that will use.4. Offer you expert economic guidance Home loan brokers need to be qualified to aid you find a home loan as well as offer you financial recommendations. They are additionally have a duty of like offer you the very best guidance they can, as opposed to just push the option that will certainly provide one of the most commission.

Take treatment of the application paperwork The world of mortgage financing has plenty of lingo and also tedious paperwork, however the experts at Loan. co.uk will deal with all that effort for you. They'll prefill your home loan application for you check my reference so your new home loan can go as smoothly as possible.

Report this wiki page